What you will see below

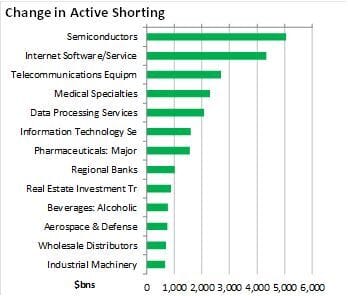

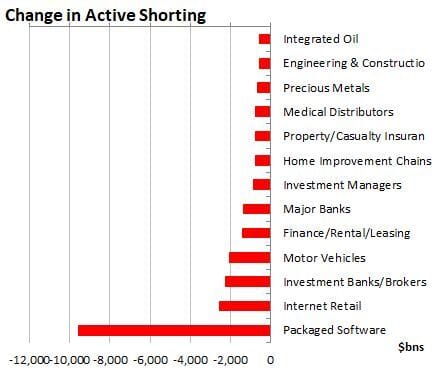

spikes and drops in short interest by industry;

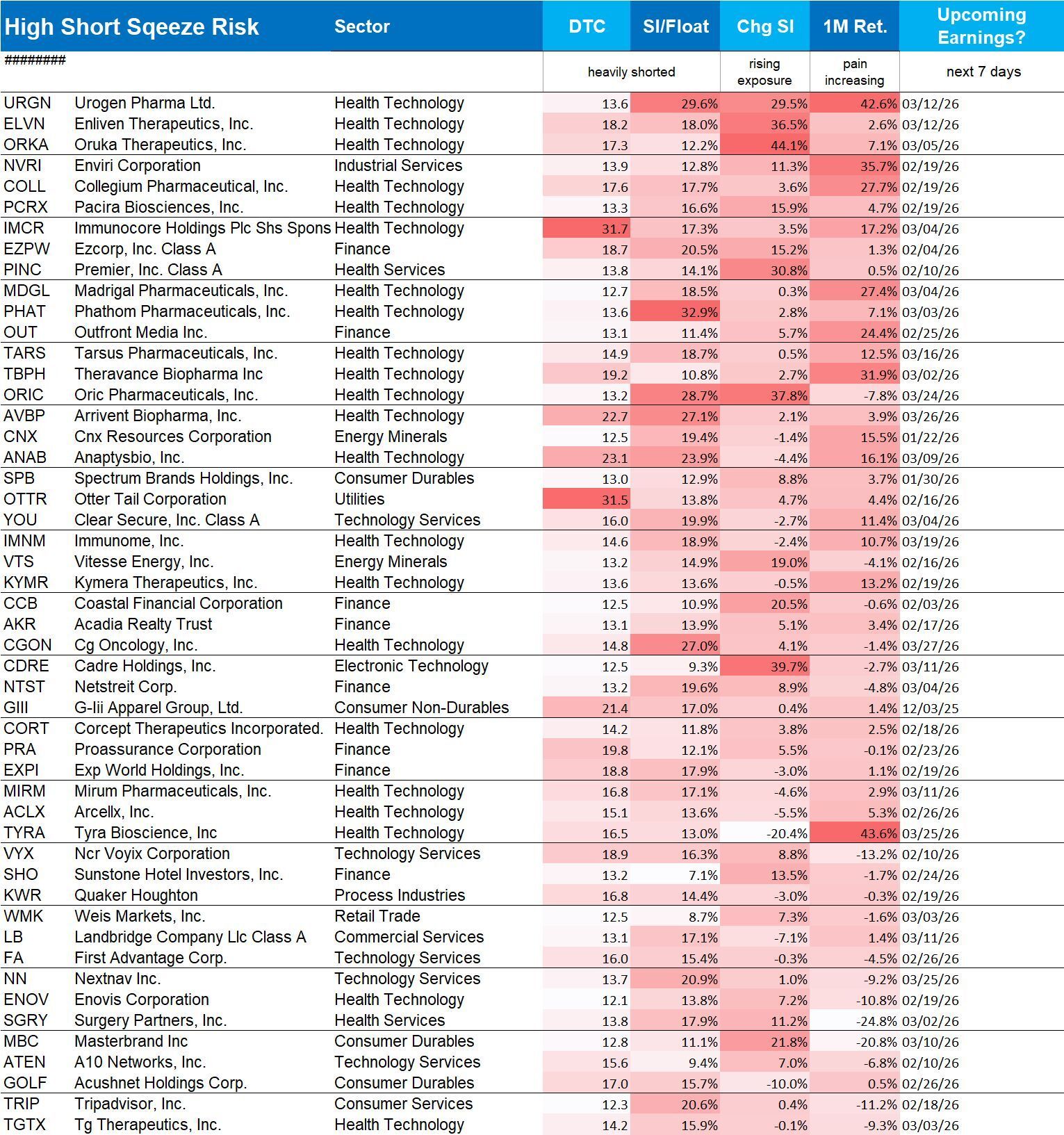

short squeeze candidates / very high short interest;

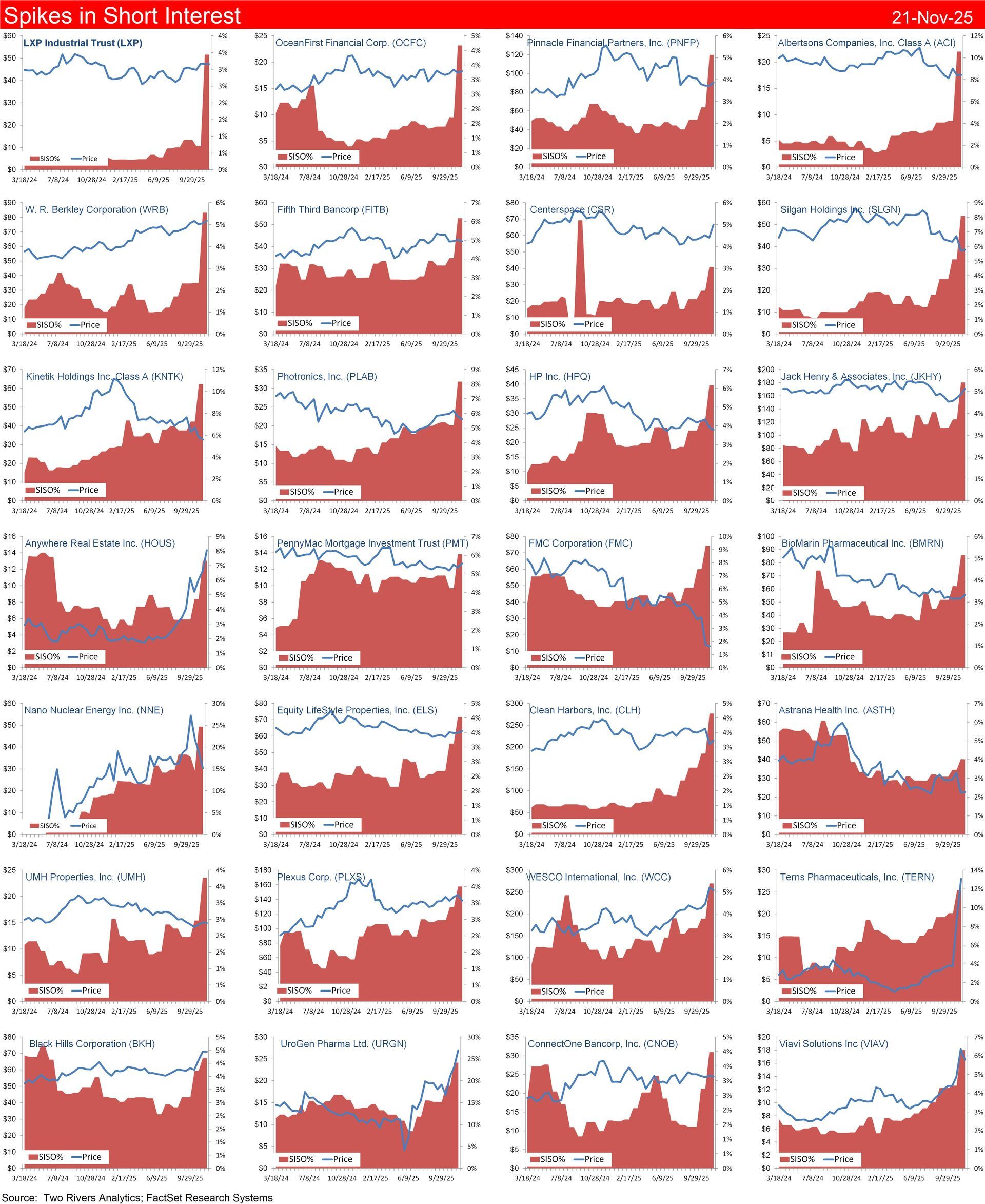

stocks showing recent spikes in short interest;

performance of the most highly shorted stocks.

The market value of short interest decreased by -5.0% ($-72.6) billion over the past 30 days. Net new active shorting decreased by $60.3 bn. The strongest short activity was seen in Semis, Internet Software and Telecom Equipment. The most short covering took place in Packaged Software, Internet Retail and Investment Banks/Brokerages.

The most heavily shorted stocks are shown below. Any stock with short interest to float of more than 30% should be treated as a squeeze risk.

Spikes in Short Interest are concentrated in financials. The broader list includes LXP Industrial, OceanFirst Financial, Pinnacle Financial, Albertsons, WR Berkley, Centerspace, Silgon and the names below.

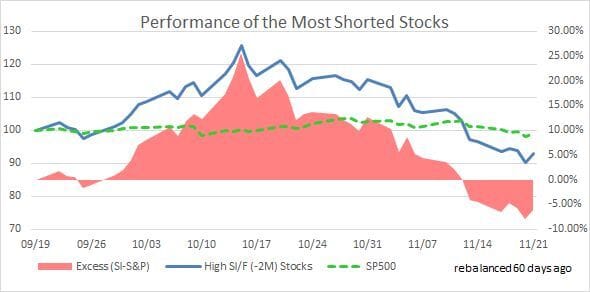

Shorts are doing better

Highly shorted stocks had been performing well through last week. Yesterday’s and today’s rallies have reversed this outcome.