New FINRA data means we are updating our squeeze risk warnings. Managers should be wary of remaining short these names or, if short, size appropriately and keep exposure on a tight leash. See below for details.

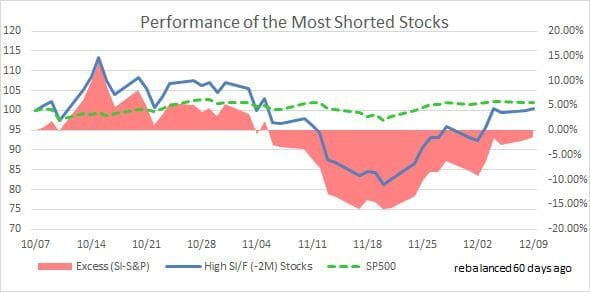

First, the performance of highly shorted stocks has been strong, again, since mid-November.

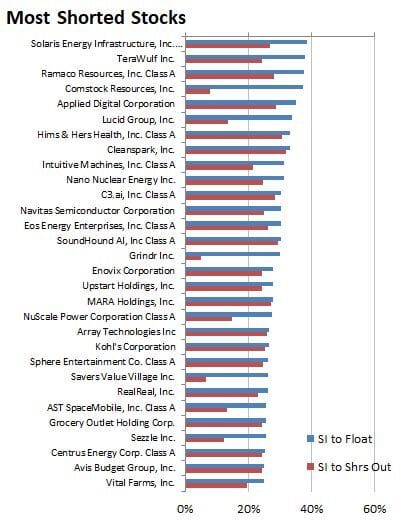

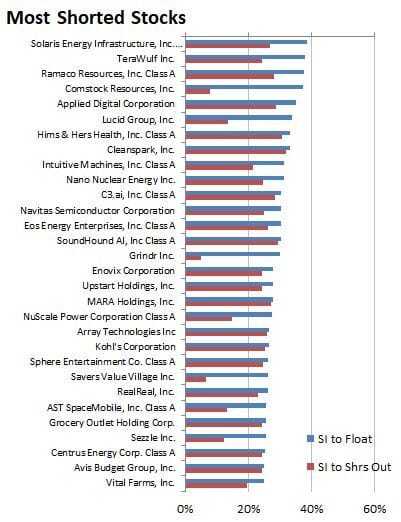

This is a simple screen showing the highest short interest to float and to shares outstanding ratios.

Here we flag TeraWulf, Lucid, Intuitive Machines, (perpetual resident here) Upstart Holdings, Hims & Hers, Applied Digital, Eos Energy, and Solaris.

The following is a more comprehensive model that looks at Short Days to Cover, the recent change in short interest and recent price movement. The idea is to highlight those stocks where funds have increased their short position recently and those positions are under pressure right now, coupled with a "narrow door" for covering the short.

Download this file in PDF, below.