New FINRA data means we are updating our squeeze risk warnings. Managers should be wary of remaining short these names or, if short, size appropriately and keep exposure on a tight leash. See below for details.

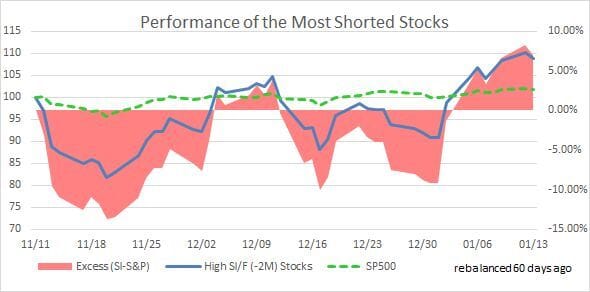

First, the performance of highly shorted stocks has been strong, again, so far this year.

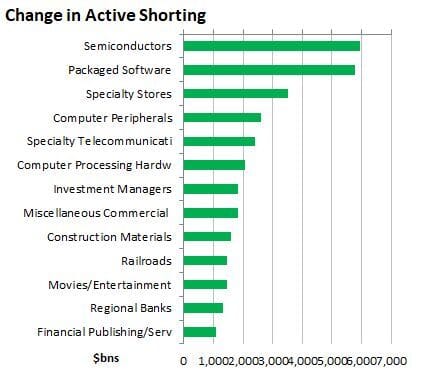

The market value of short interest increased by 4.9% ($69.8) billion over the past 30 days. Net new active shorting increased by $44.4 bn. The strongest short activity was seen in Semis, Packaged Software and Specialty Stores. The most short covering took place in Telecom, Homebuilders and Electric Utilities.

Spikes in Short Interest include: Trump Media & Technology Group, Omnicom Group, QuinStreet, SharpLink Gaming, Archer Aviation, AAR CORP., Astronics Corporation, AeroVironment, and BWX Technologies.

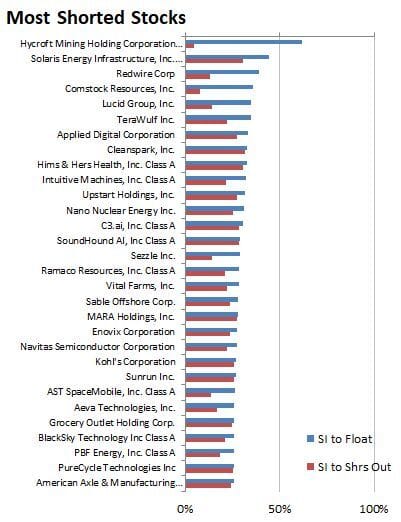

This is a simple screen showing the highest short interest to float and to shares outstanding ratios.

Here we flag Hycroft Mining, Solaris, Redwire, Lucid and Applied Digital as having SI exceeding 33% of float.

The following is a more comprehensive model that looks at Short Days to Cover, the recent change in short interest and recent price movement. The idea is to highlight those stocks where funds have increased their short position recently and those positions are under pressure right now, coupled with a "narrow door" for covering the short.

Download this file, with additional charts, in PDF, below.