What you will see below

performance of the most highly shorted stocks;

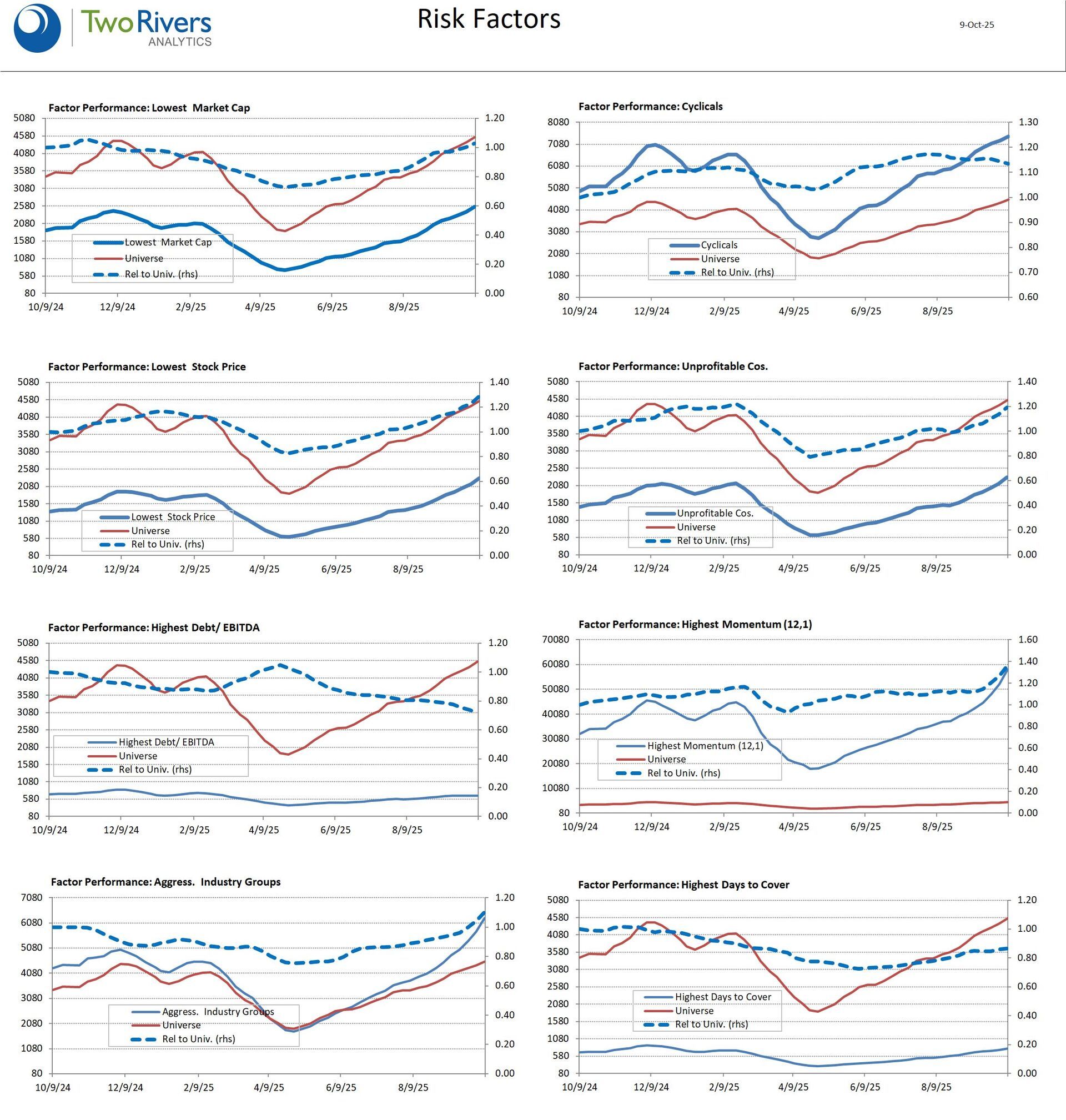

performance of the factors most related to shorting;

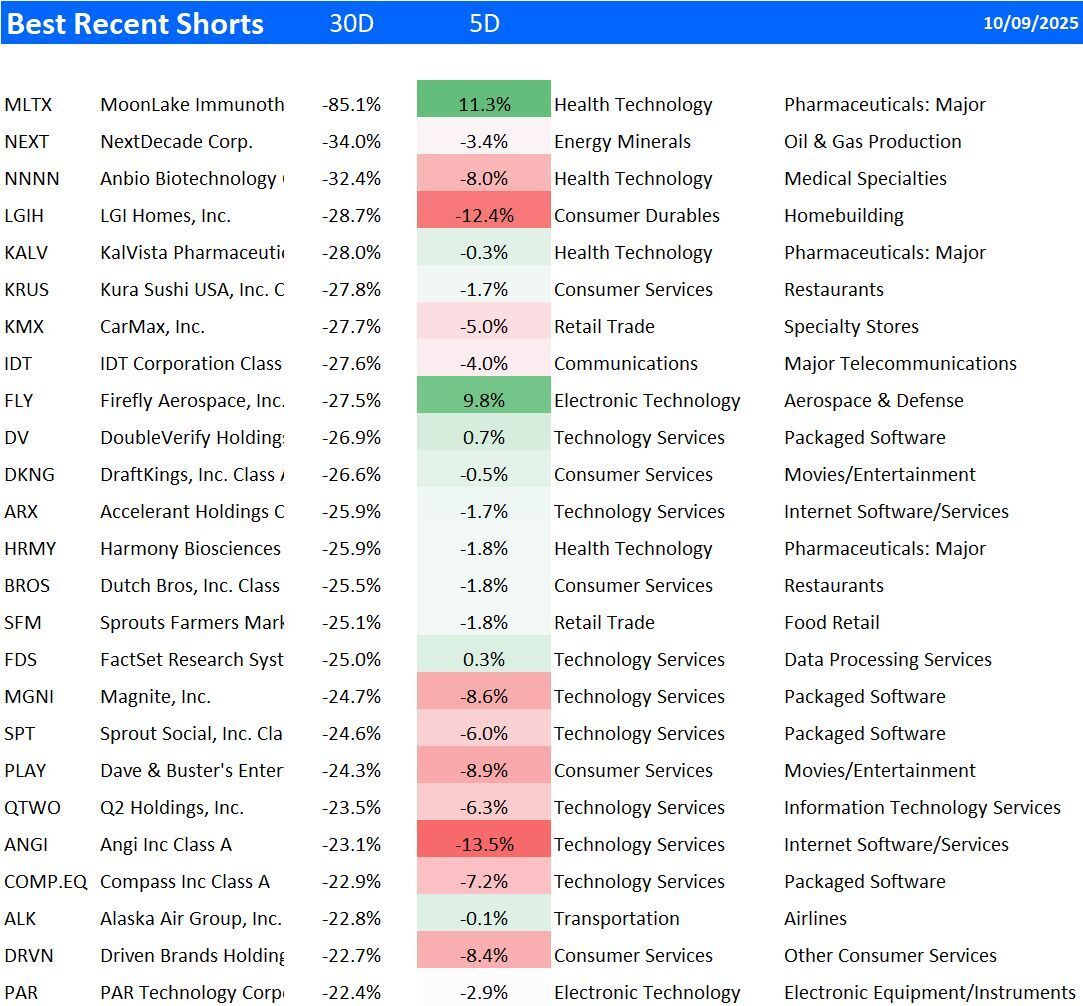

characteristics of the best shorts over the last 30 days;

list of recent “plungers”.

Friday comes to the shorts’ rescue again. Investors boosted highly shorted shares through Wednesday. Navitas, Solaris Energy and beleaguered Kohl’s stocks rallied hard. Kohl’s has 46% of its shares short, Groupon has 44%. We would be careful of a sharp squeeze in both cases.

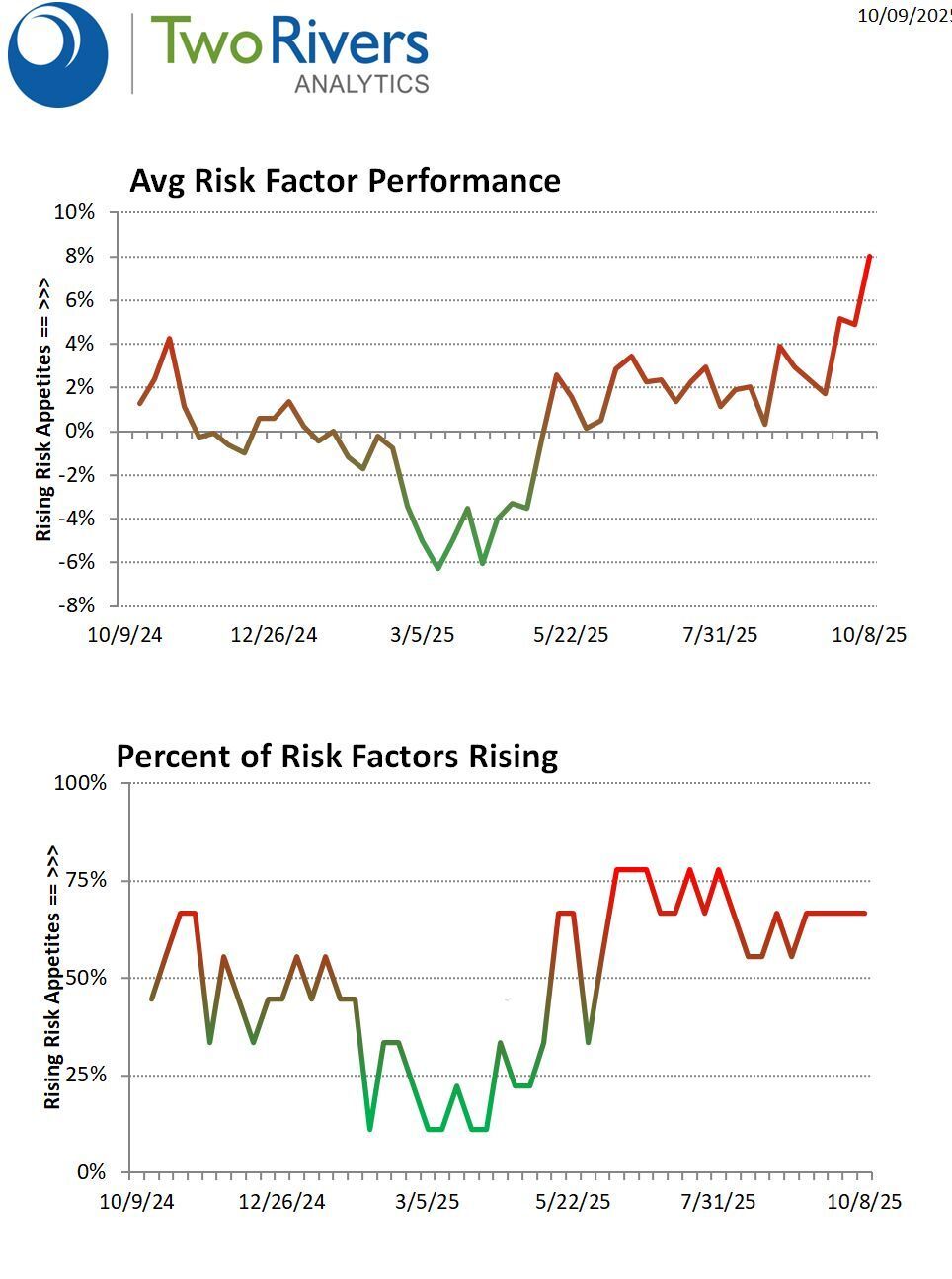

Our tracked risk factors strengthened further and are dangerously overbought.

Which risk factors are rising/falling?

• Rising factors comprise: Low Market Cap, Low Stock Price, Aggressive Industry Groups, High Momentum (12,1), High Days to Cover

• Falling factors comprise: High Debt/ EBITDA, Cyclicals.

• No factors changed direction.

Over the past 30 days, the best shorts underperformed the universe by -18.2%, (-18.9%, vs. -0.7%). Compared to the universe, they:

* were $1,951mn smaller cap,

* had 24% higher beta,

* had lower long term forecast earnings growth,

* had higher next 12M sales growth,

* had lower next 12M EPS growth,

* had weaker 12M momentum,

* generate higher value-add,

* are less capital intensive,

* are investing less currently,

* have lower EV/S multiples,

* have higher EV/EBITDA multiples,

* have higher short interest ratios,

* have higher days to cover.

The “plungers” list this week includes Sable Offshore Corp., Forward Air, Korean Deposit, Build-A-Bear Workshop and a gaggle of biotechs.