What you will see below

the performance of the most highly shorted stocks;

performance of the factors most related to shorting;

characteristics of the best shorts over the last 30 days;

list of recent “plungers”.

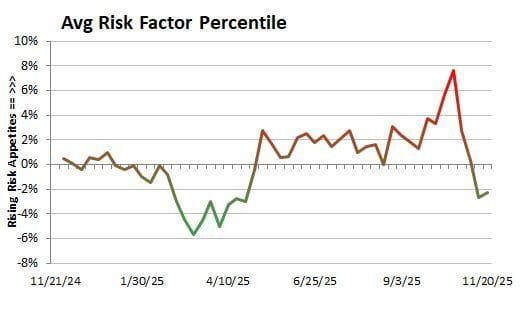

Shorts are having another good week. This week’s positive results built on last week’s market downdraft and, more importantly, the shift away from risk assets and riskier stock characteristics. Some notable highly shorted stocks bucking the downtrend were Rocket Companies, TeraWulf, and Tempus. Note that nuclear, electric vehicles and AI infrastructure themes were especially hard-hit.

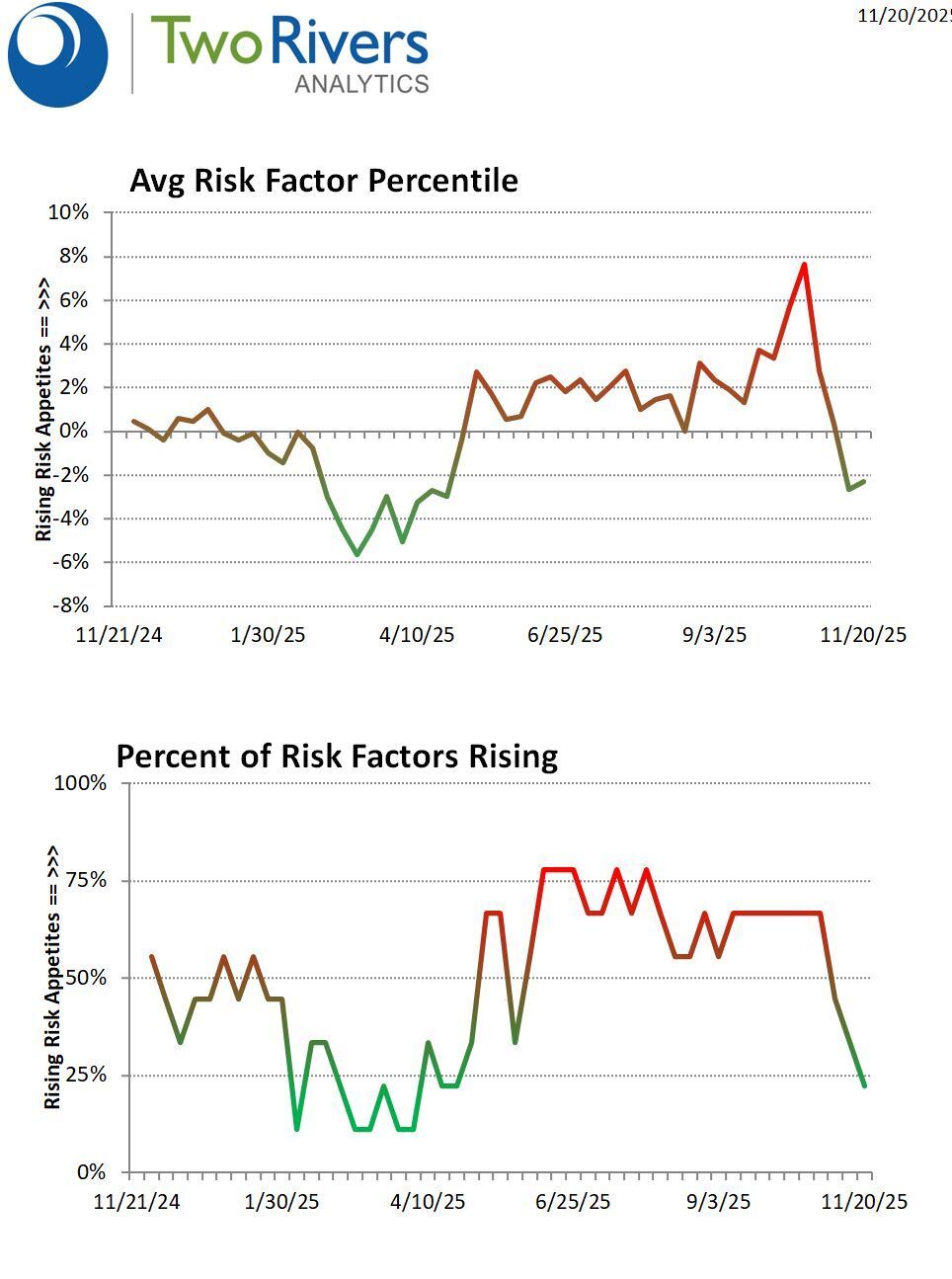

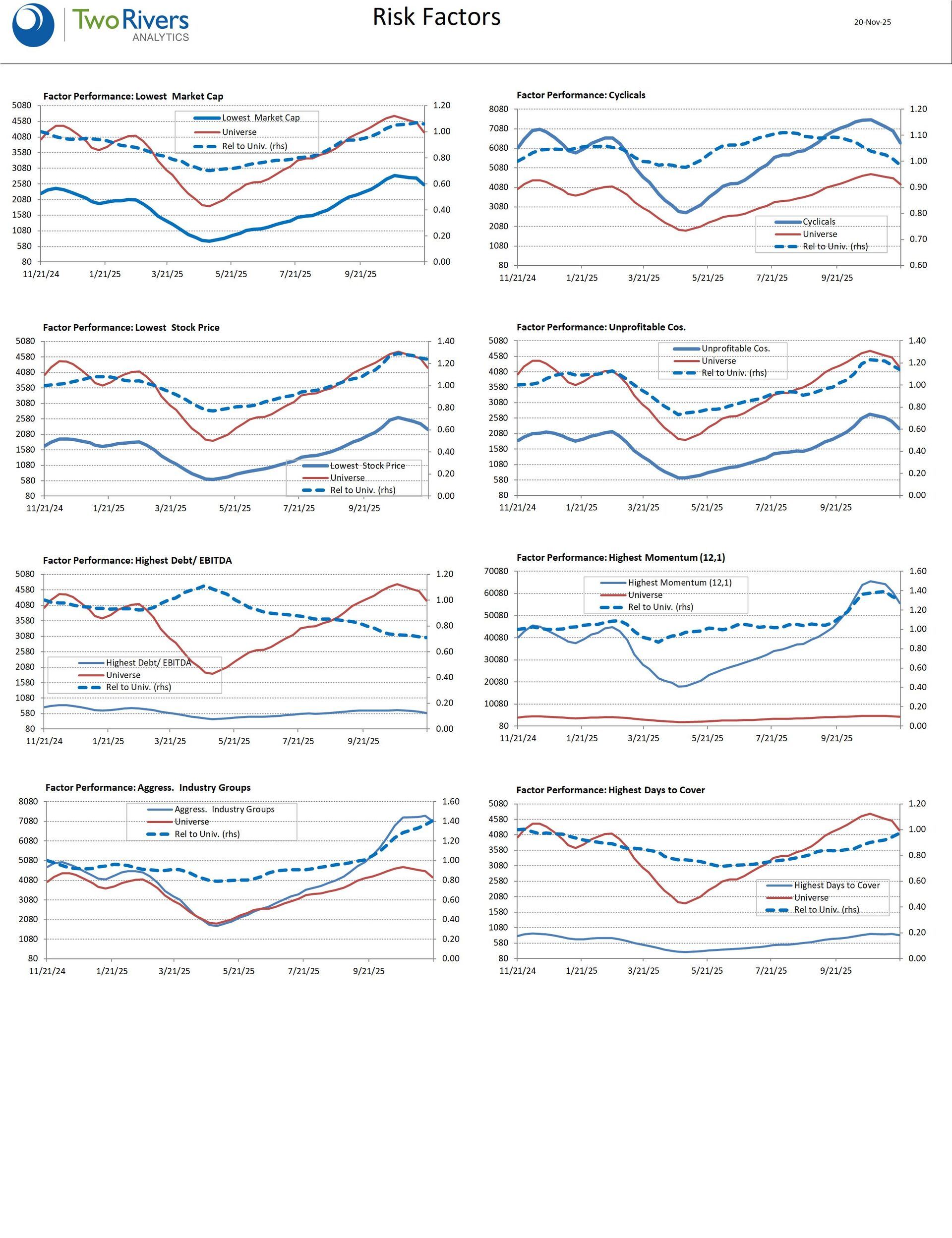

Our tracked risk factors are flat to down this week. A third decisive risk-off week has taken risk appetites below neutral but not far enough to call for an imminent bounce yet.

Which risk factors are rising/falling over the past week?

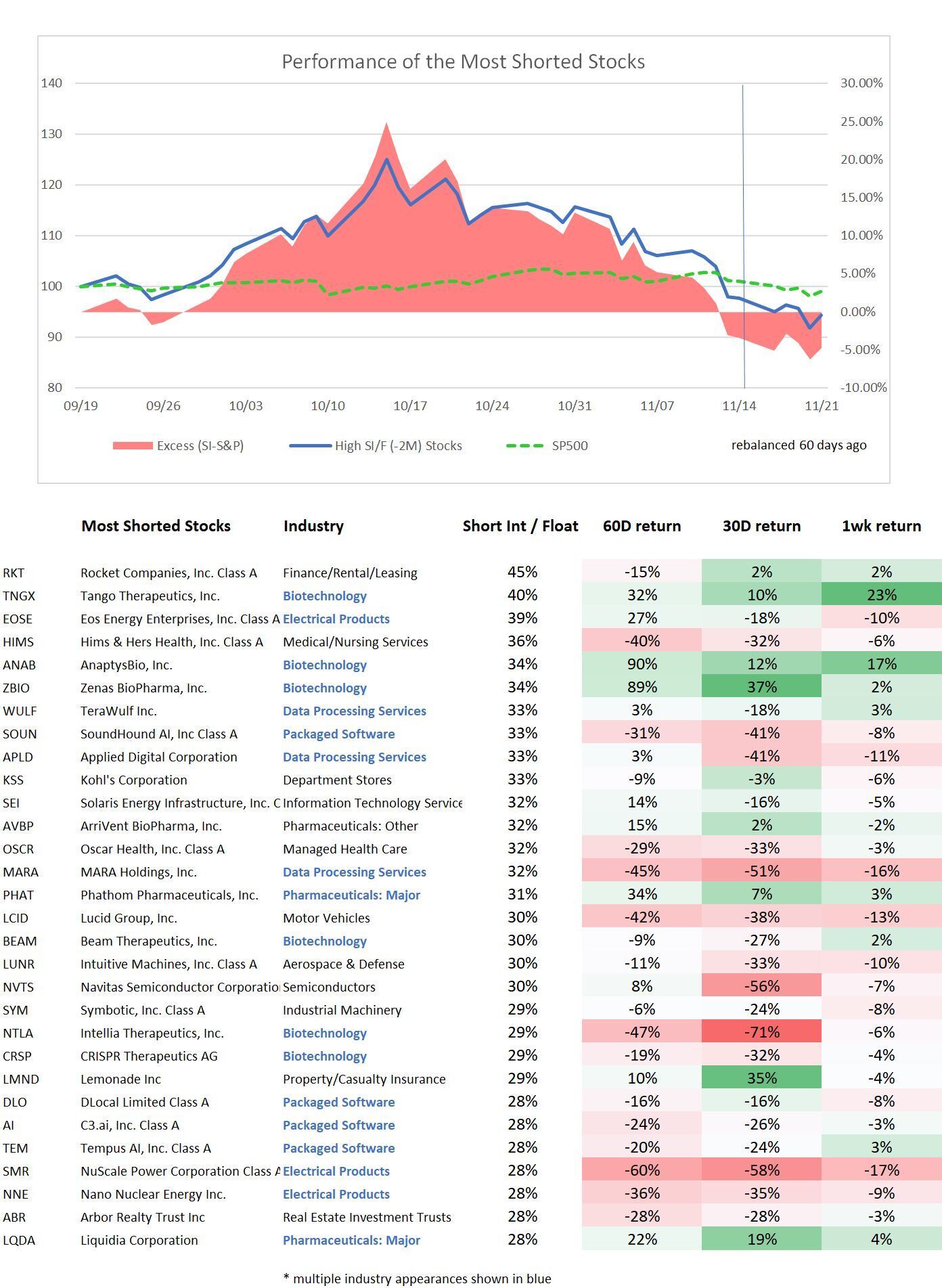

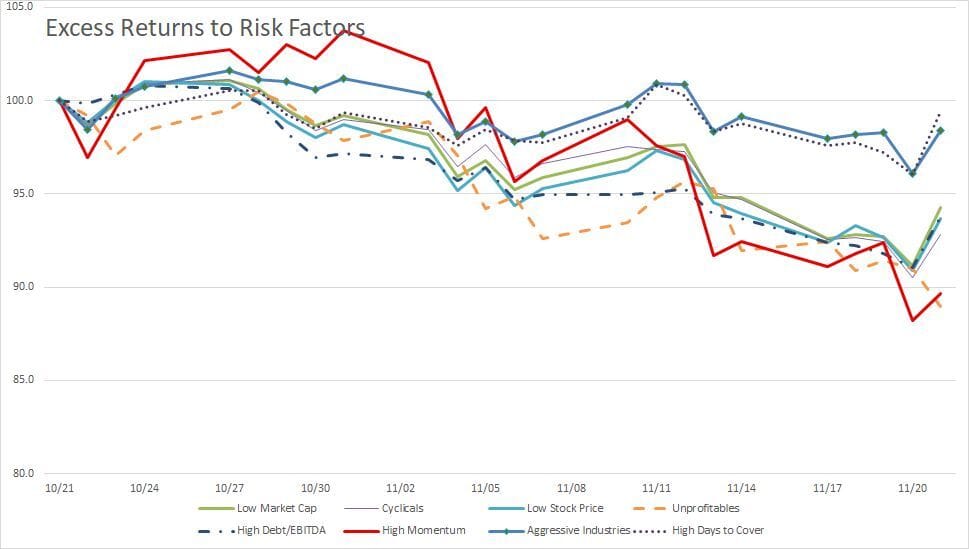

Most short-oriented risk factors were down on the week although some recovered partially on Friday. Momentum and unprofitable company stocks fell hardest, dropping 3.0 and 3.3%, respectively, over the past week.

Which risk factors are rising/falling over the past 30 days?

• Rising factors comprise: Aggressive Industry Groups, and High Days to Cover,

• Falling factors comprise: Low Market Cap, Low Stock Price, High Debt/ EBITDA, Cyclicals, and High Momentum.

• No risk factors turned up, while Low Market Cap stocks turned down.

Over the past 30 days, the best shorts underperformed the universe by -37.3%, (-43.3%, vs. -6.1%). Compared to the universe, they:

* were $2,496mn smaller cap,

* had 60% higher beta,

* had higher long term forecast earnings growth,

* had higher next 12M sales growth,

* had lower next 12M EPS growth,

* had stronger 12M momentum,

* generate lower value-add,

* are less capital intensive,

* are investing less currently,

* have higher EV/S multiples,

* have higher EV/EBITDA multiples,

* have higher short interest ratios,

* have lower days to cover.

The “plungers” list this week includes Picard Medical, Ramaco Resources, Critical Metals, United States Antimony, USA Rare Earth, NuScale, MARA, StubHub Holdings, Lightbridge Corporation, and the usual cluster of biotechs.