What you will see below

the performance of the most highly shorted stocks;

performance of the factors most related to shorting;

characteristics of the best shorts over the last 30 days;

list of recent “plungers”.

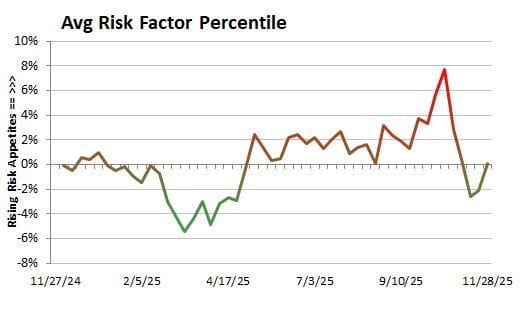

Shorts gave up nearly all the relative gains they enjoyed since the bottoms of October 15th. Highly shorted stocks outgained the S&P by nearly 1500 bps in a little more than a week. Some notable names with very strong gains include TeraWulf, Applied Digital, Symbotic, Kohls and Bitdeer Tech.

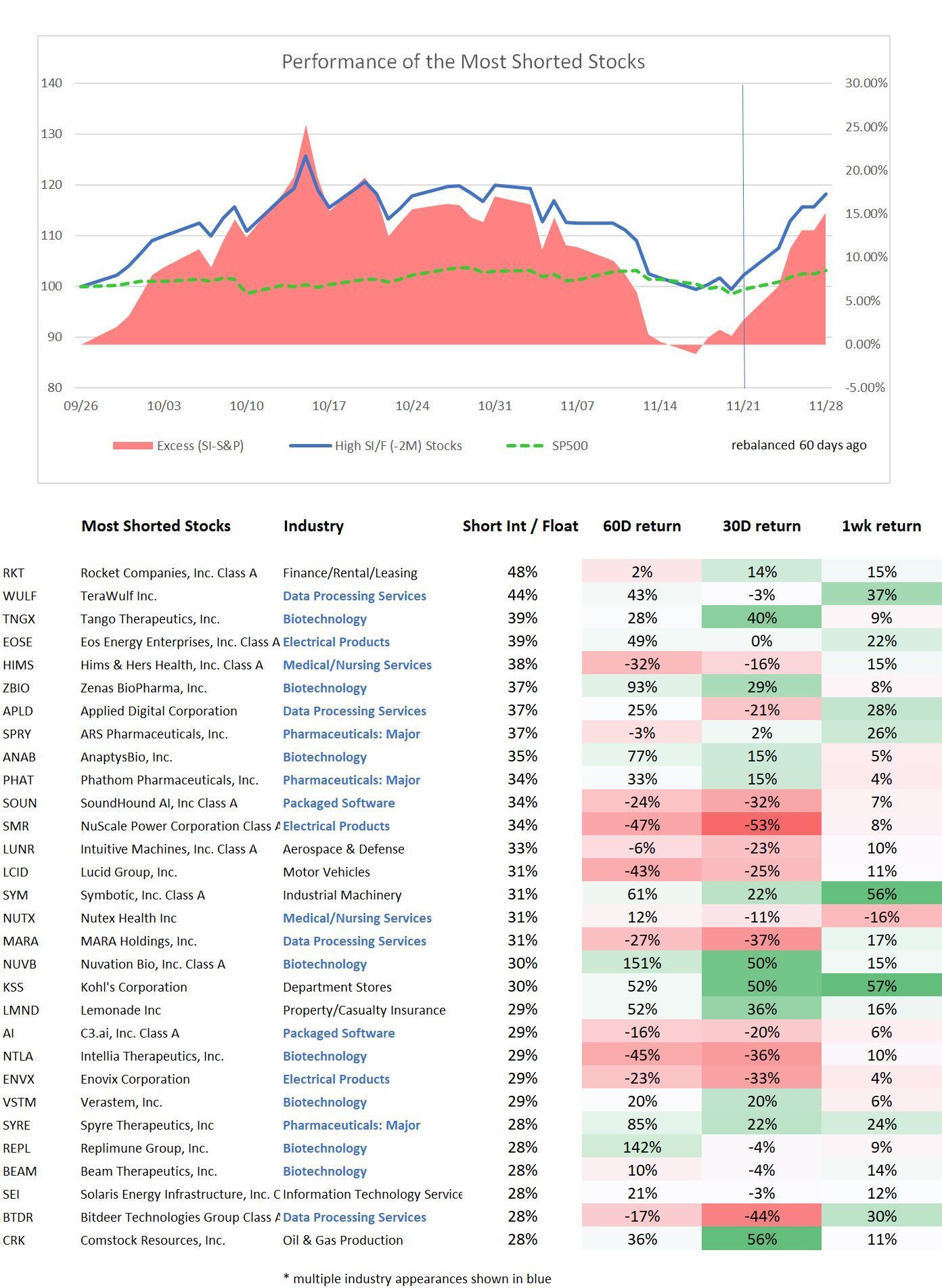

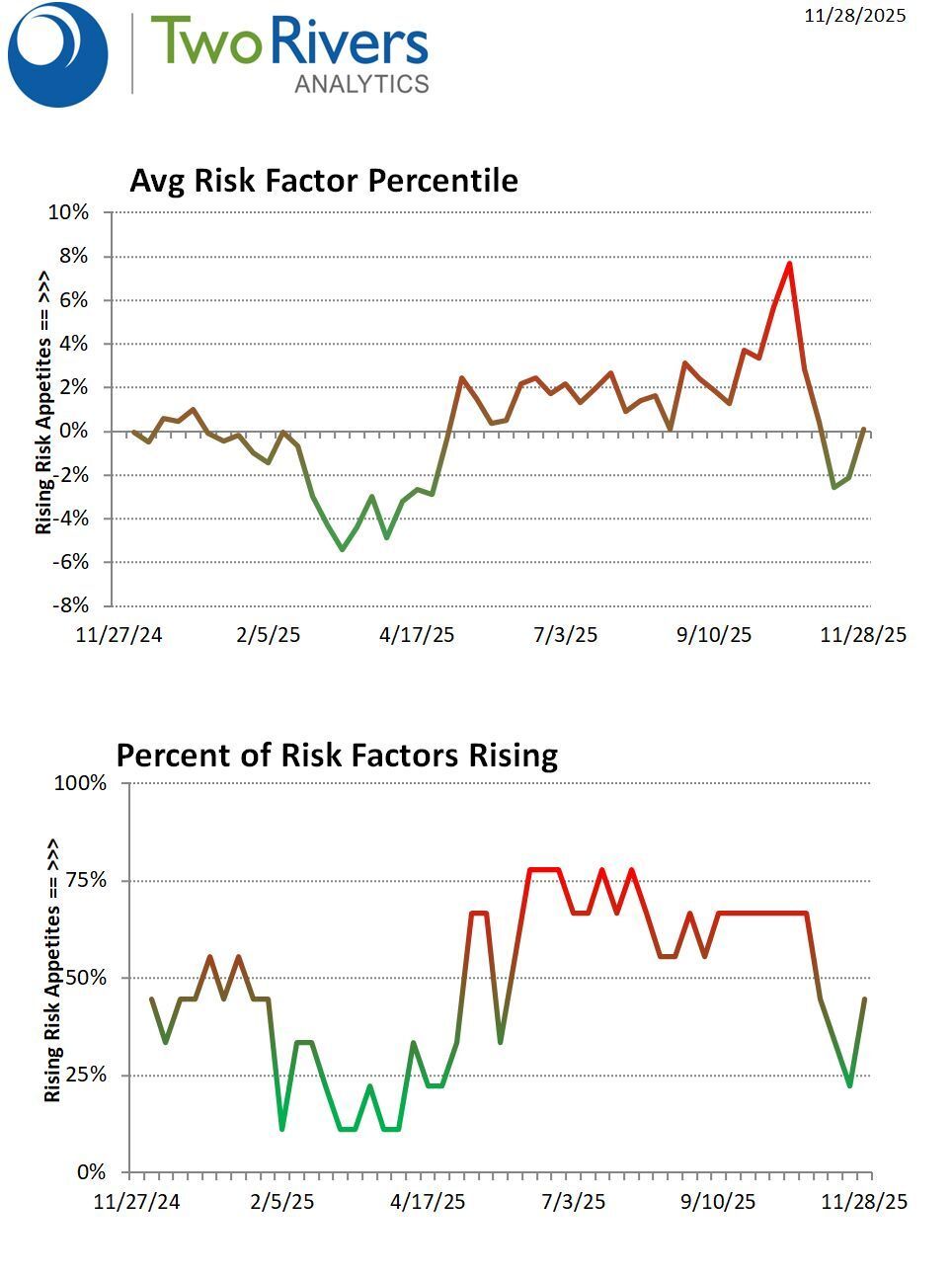

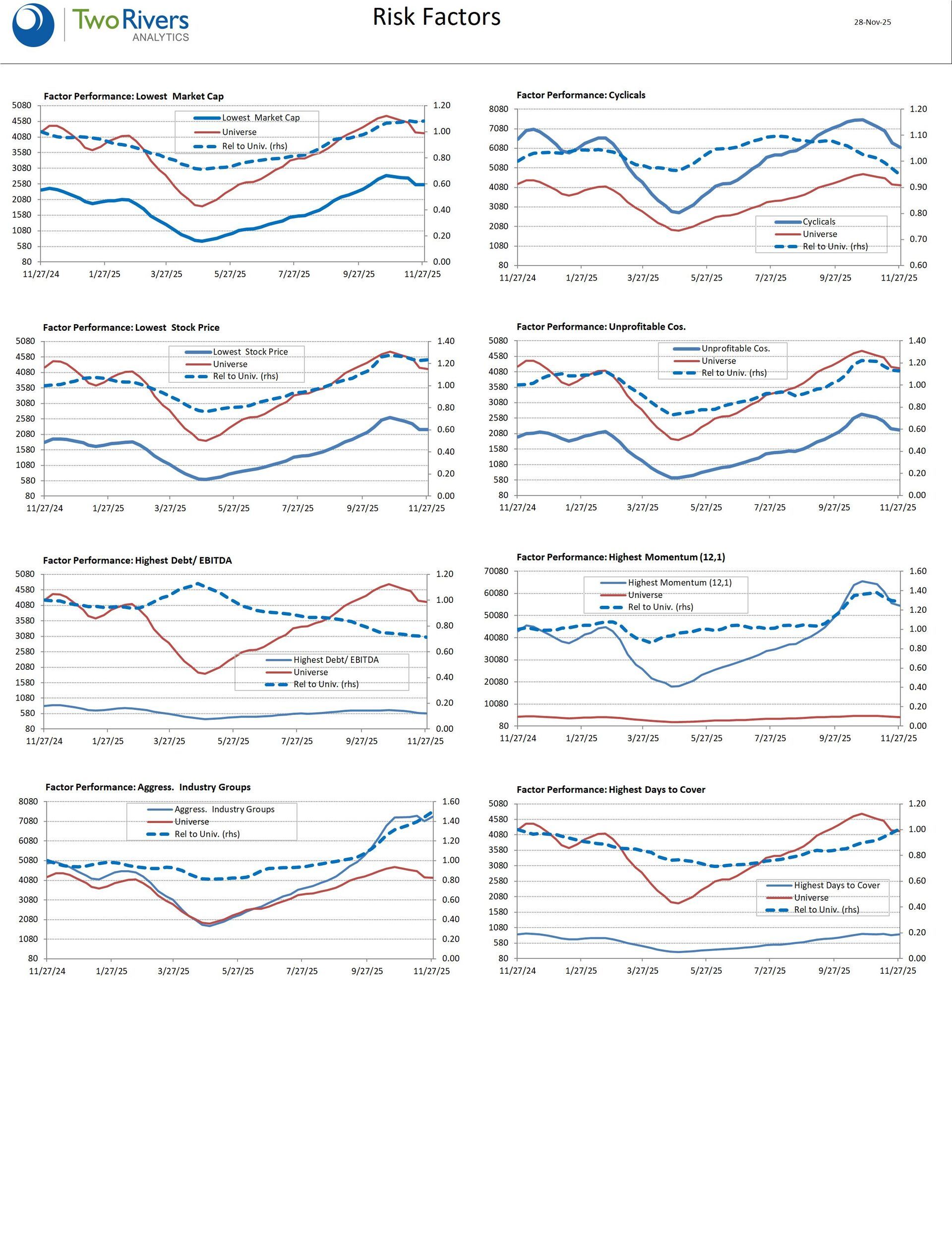

Our tracked risk factors have been bid back up. We underestimated how much the market’s risk-off posture leading into last week could power a bounce.

Which risk factors are rising/falling over the past week?

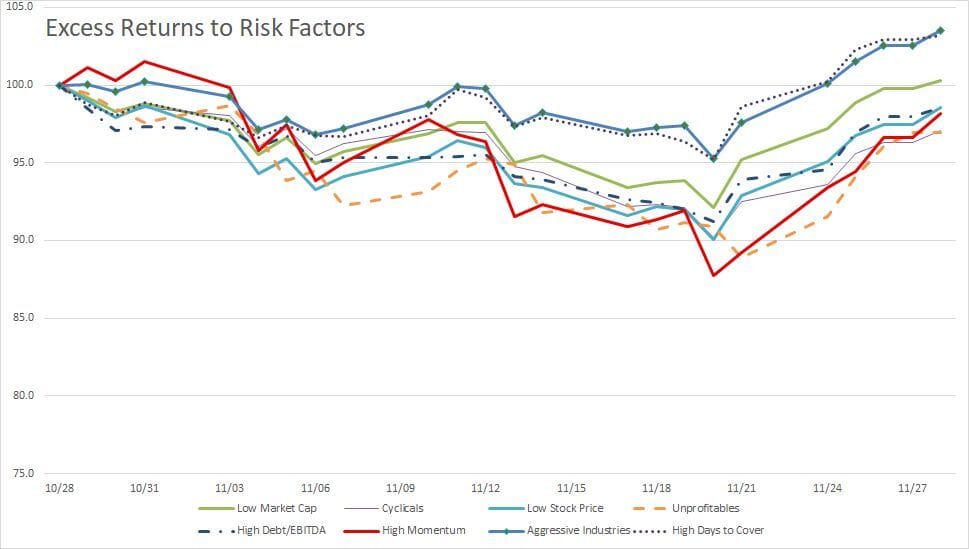

Every short-linked risk factor was up sharply on the week. Momentum and unprofitable company stocks were the strongest performers, gaining 3.9% and 4.2%, respectively. (Ask us for the list of stocks in each bucket.) Note that some of these factors are still lower than where they were a month ago. This why MO is shown as a net loser over the past 30 days on the next page.

Which risk factors are rising/falling over the past 30 days?

• Rising factors comprise: Low Market Cap, Low Stock Price, Aggressive Industry Groups, and High Days to Cover,

• Falling factors comprise: High Debt/ EBITDA, Cyclicals, and High Momentum,

• Low Market Cap and Low Stock Price factors turned up while no factors turned down.

Over the past 30 days, the best shorts underperformed the universe by -34.4%, (-35.2%, vs. -0.8%). Compared to the universe, they:

* were $2,926mn smaller cap,

* had 56% higher beta,

* had higher long term forecast earnings growth,

* had higher next 12M sales growth,

* had lower next 12M EPS growth,

* had stronger 12M momentum,

* generate lower value-add,

* are less capital intensive,

* are investing less currently,

* have higher EV/S multiples,

* have higher EV/EBITDA multiples,

* have higher short interest ratios,

* have lower days to cover.

The “plungers” list this week includes Sable Offshore, SuperX AI Technology, Stride, Inc., Terrestrial Energy, Ardent Health, and the usual cluster of biotechs.