What you will see below

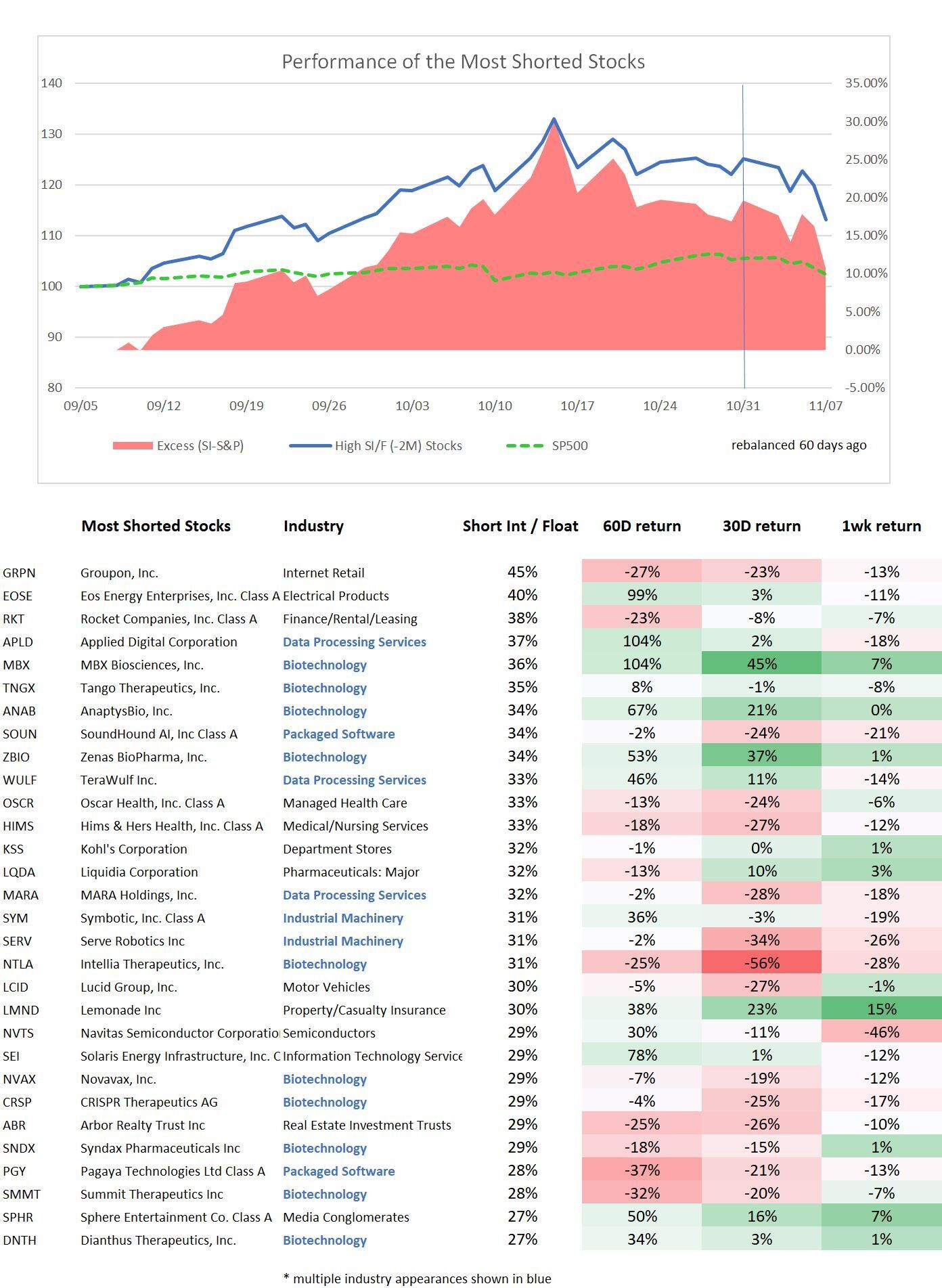

performance of the most highly shorted stocks;

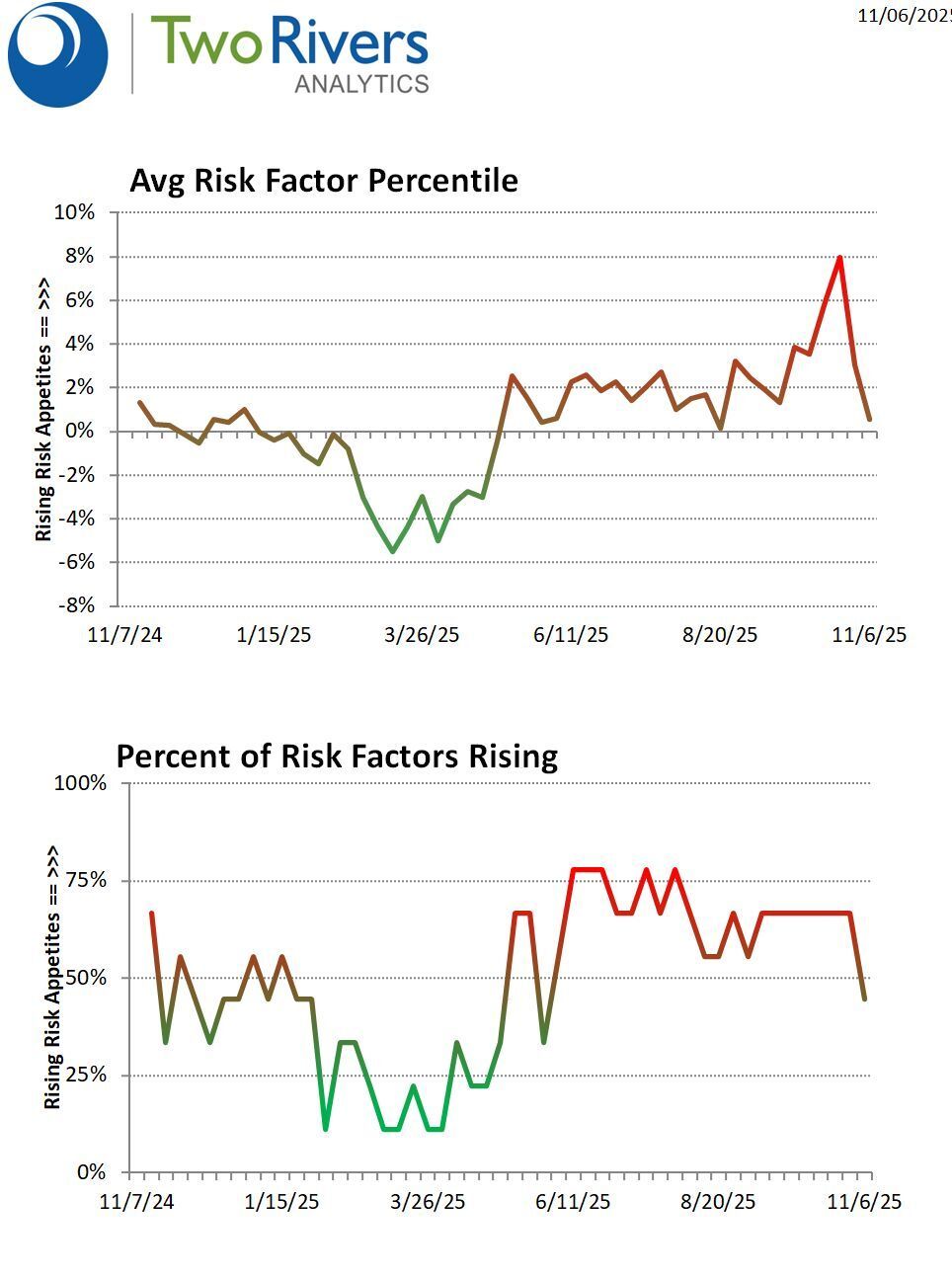

performance of the factors most related to shorting;

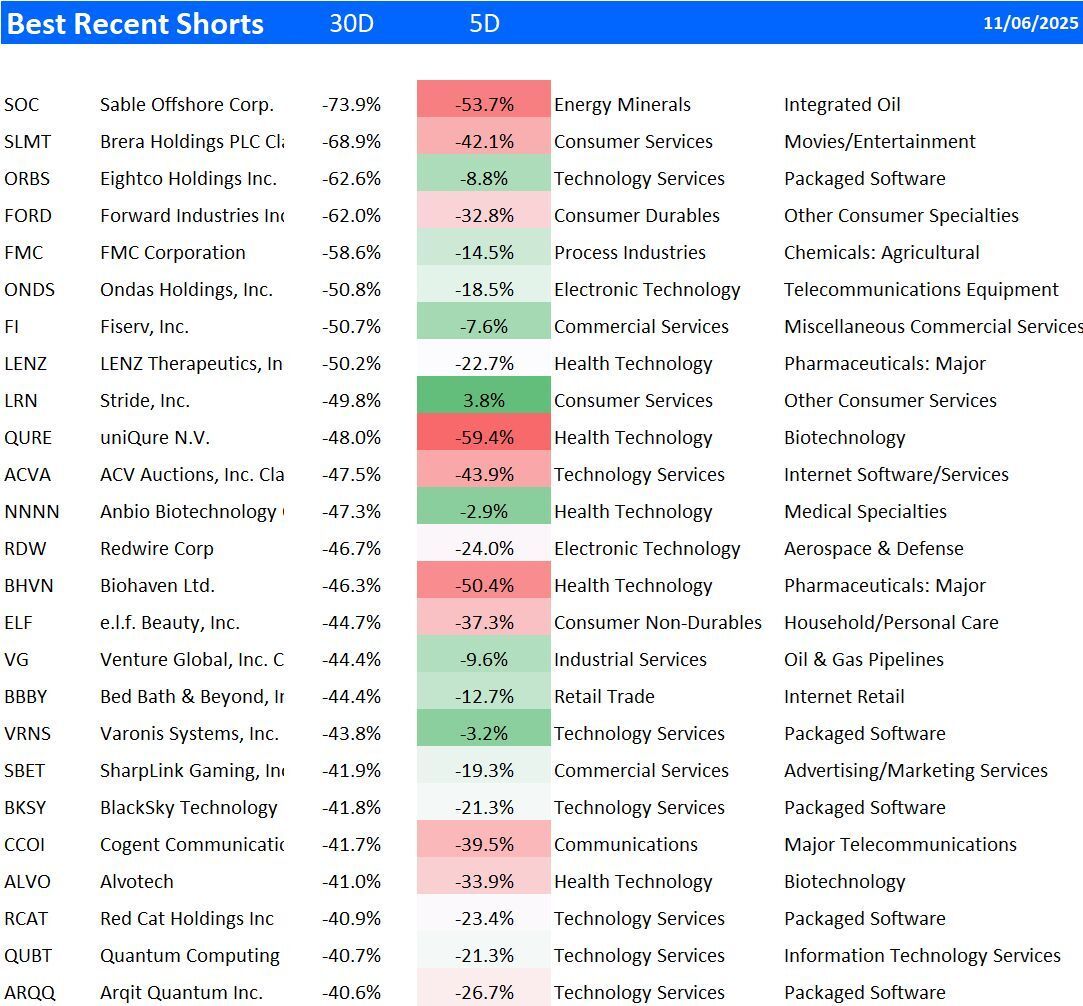

characteristics of the best shorts over the last 30 days;

list of recent “plungers”.

Shorts are down on the week. Highly shorted stocks fell a bit more, generating some elusive short alpha Some notables increases include Lemonade and Sphere Entertainment.

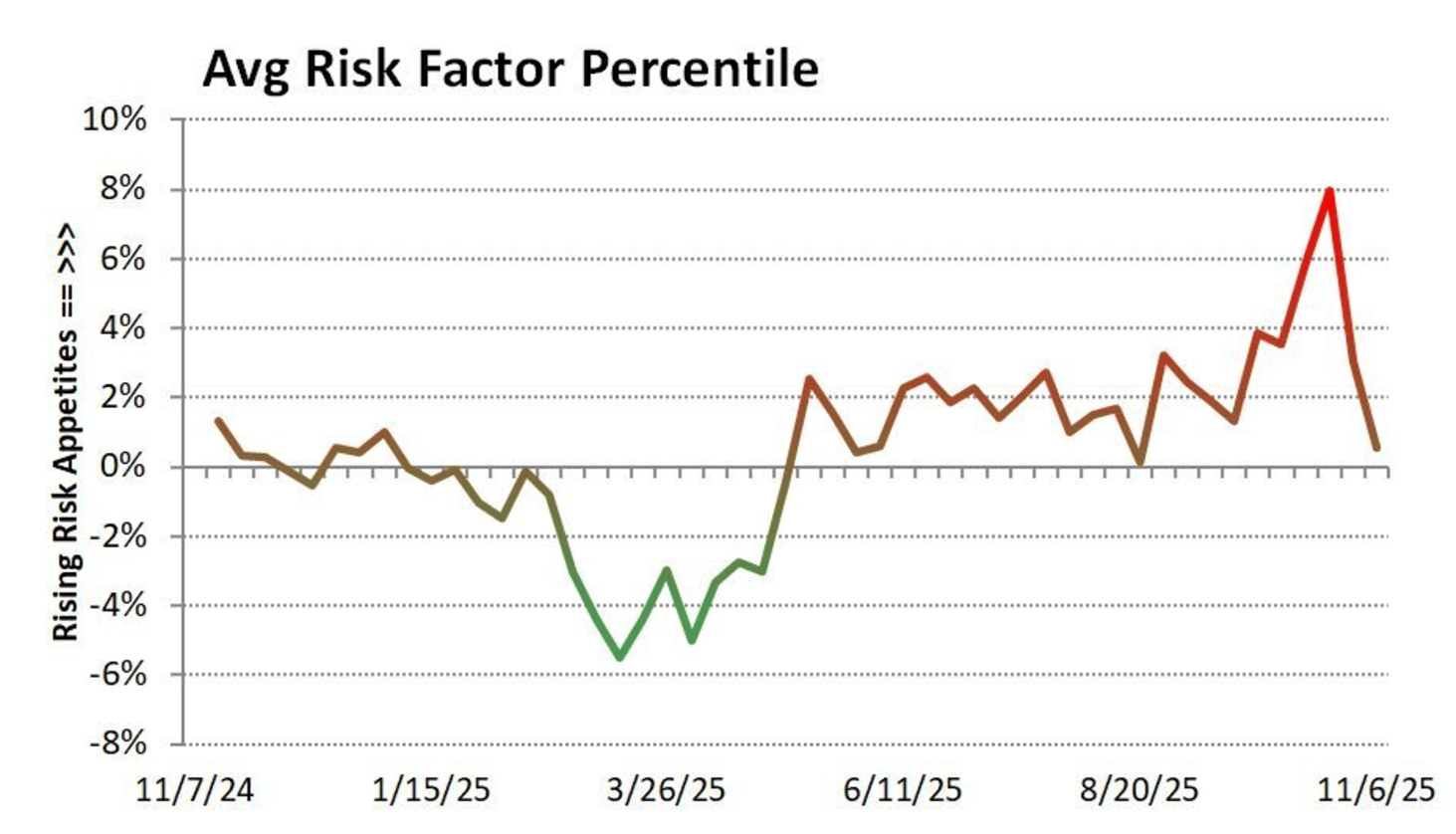

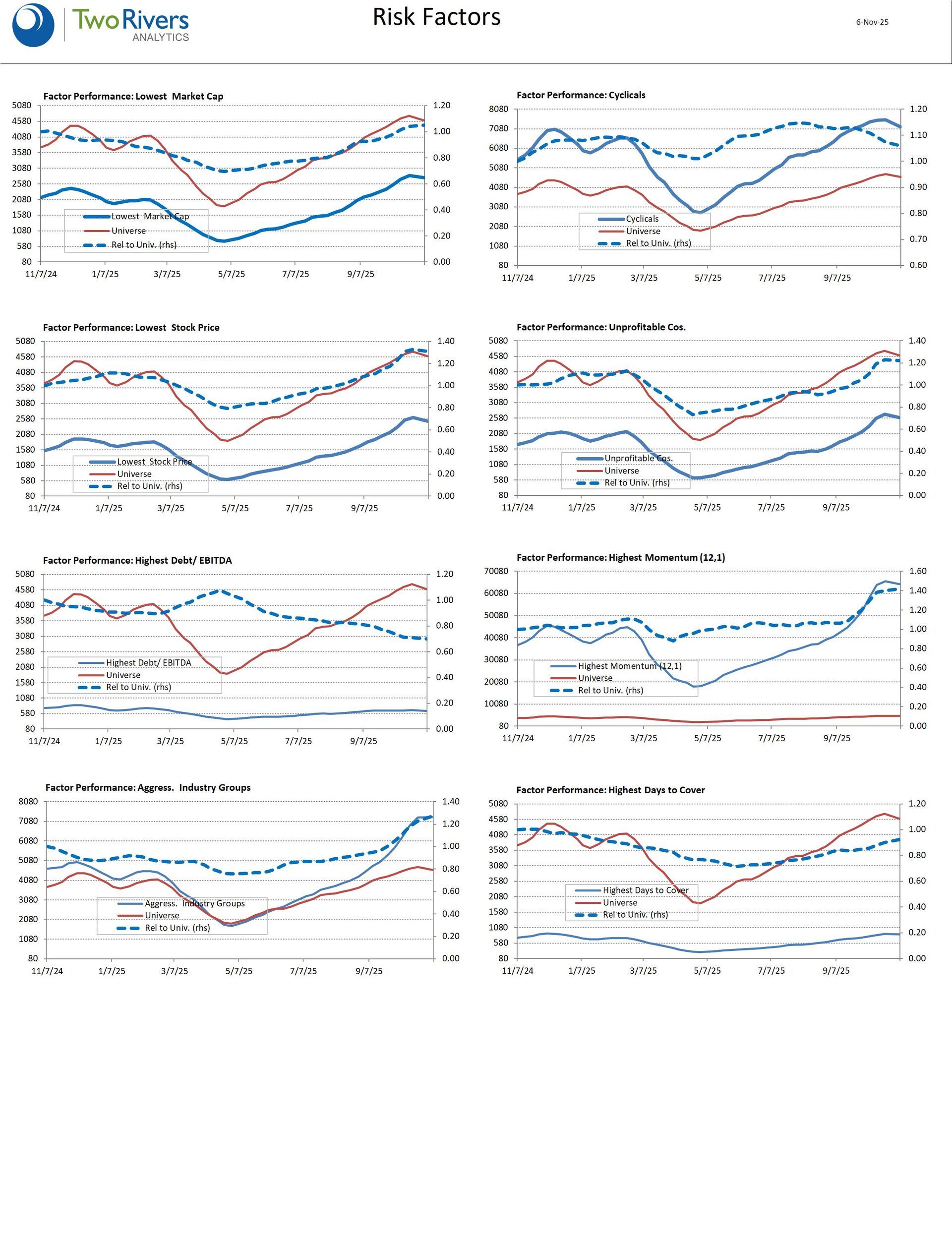

Our tracked risk factors strengthened further and are dangerously overbought.

Which risk factors are rising/falling?

· Rising factors comprise: Low Market Cap, Aggressive Industry Groups, High Momentum (12,1), High Days to Cover,

· Falling factors comprise: Low Stock Price, High Debt/ EBITDA, Cyclicals,

· No factors turned up, while Low Priced Stocks turned down.

Over the past 30 days, the best shorts underperformed the universe by -29.9%, (-33.2%, vs. -3.3%). Compared to the universe, they:

were $2,551mn smaller cap,

had 68% higher beta,

had lower long term forecast earnings growth,

had higher next 12M sales growth,

had lower next 12M EPS growth,

had stronger 12M momentum,

generate lower value-add,

are less capital intensive,

are investing less currently,

have higher EV/S multiples,

have higher EV/EBITDA multiples,

have higher short interest ratios,

have lower days to cover.

The “plungers” list this week includes Sable Offshore Corp., Brera Holdings, uniQure N.V., ACV Auctions, Cogent Communications Inc, American Superconductor and some biotechs.