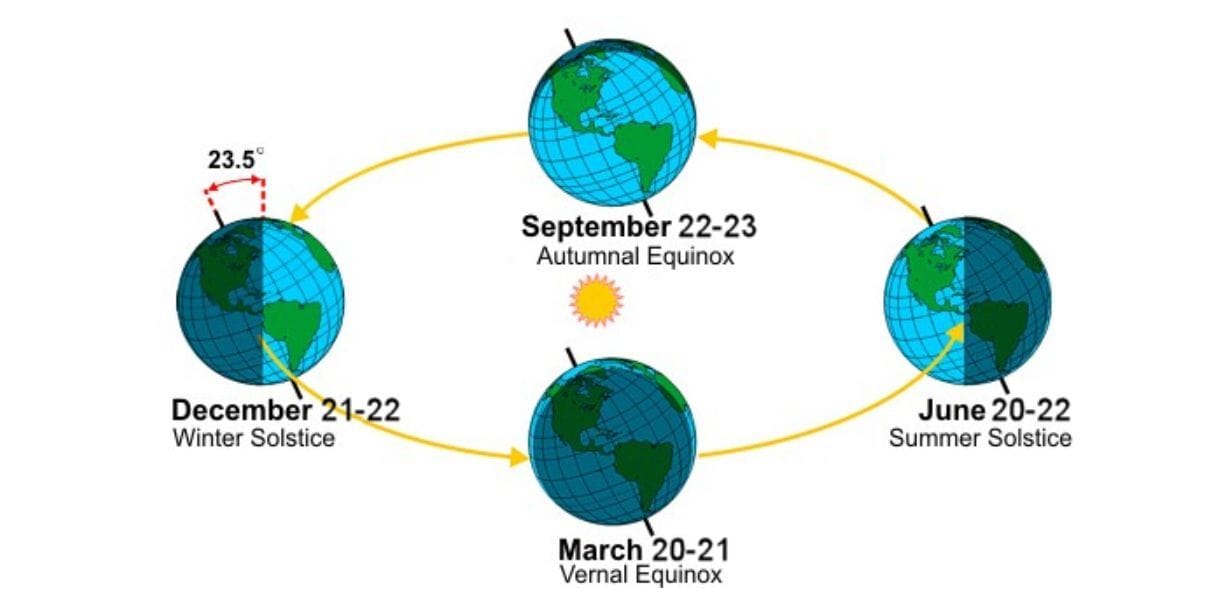

As the Northern Hemisphere tilts on its axis to offer its most parsimonious display of daylight, the astute observer might note a profound philosophical symmetry between the Winter Solstice and the Short Sale. Both represent a calculated bet on the persistence of darkness and the inevitable contraction of perceived value.

________________________________________

The Scarcity of the Upside

On the shortest day of the year, the sun performs what can only be described as a "dead cat bounce" across the horizon—a brief, unconvincing rally before retreating into the safety of the night. For the equity bear, this is the ideal metaphysical environment.

In both arenas, one is operating under the constraints of borrowed time:

• The Solstice: A temporary cosmic deficit where we borrow minutes from the afternoon to pay for a surplus of evening.

• The Short Position: A temporary fiscal deficit where we borrow shares from a broker to pay for a surplus of hubris.

The Psychology of Pessimism

There is a certain highbrow masochism shared by those who celebrate the solstice and those who short equities. It requires a refined palate to find joy in a shrinking value. While the "long-only" crowd functions like the sun-drenched revelers of the summer solstice—bloated on optimism and vitamin D—the short seller thrives in the permafrost of dodgy footnotes or uncovering broken business models.

The short seller understands what the ancient Druids suspected: that there is a distinct, albeit terrifying, profit to be found when the "highs" of the year are behind us. They do not fear the long night; they have already priced it in.

The Risks of the Reversal

However, both the astronomer and the fund manager must contend with the inevitability of the pivot. The solstice is the moment of peak darkness, yet it marks the precise second when the "trend" reverses.

"Short selling is the only endeavor where one can be fundamentally correct about the darkness, yet find oneself utterly incinerated by the first ray of dawn."

Just as the days begin to lengthen the moment we acknowledge their brevity, a short squeeze often triggers the moment the "darkness" feels most certain. In both cases, the "unlimited upside" of the sun (or a meme stock) can prove catastrophic for those who have positioned themselves against the light.

________________________________________

Comparative Summary:

The Winter Solstice

Primary Outlook: Distinctly Bearish (Photons)

Duration: 24 hours

Risk Profile: Seasonal Affective Disorder

Ideal Attire: Cashmere turtleneck or druid priestly garb

The Short Position

Primary Outlook: Distinctly Bearish (Price)

Duration: Until the Margin Call

Risk Profile: Theoretically Infinite Ruin

Ideal Attire: A fleece vest and a grimace

Here’s to wishing you, your colleagues, clients and your families very long days (and lots of short alpha) in 2026!

Two Rivers Research