What you will see below

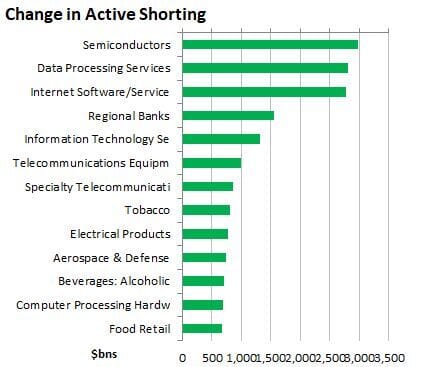

spikes and drops in short interest by industry;

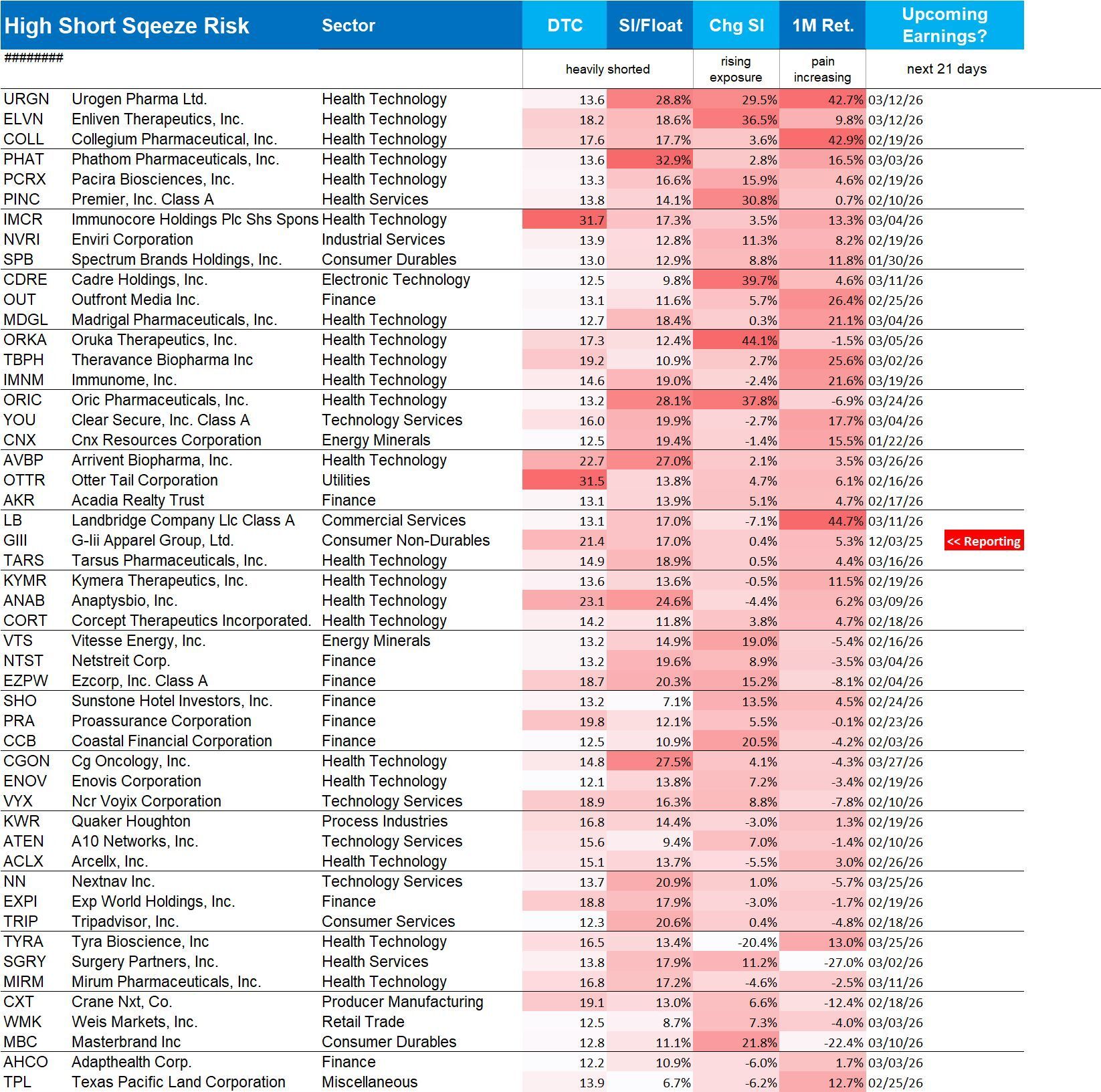

short squeeze candidates / very high short interest;

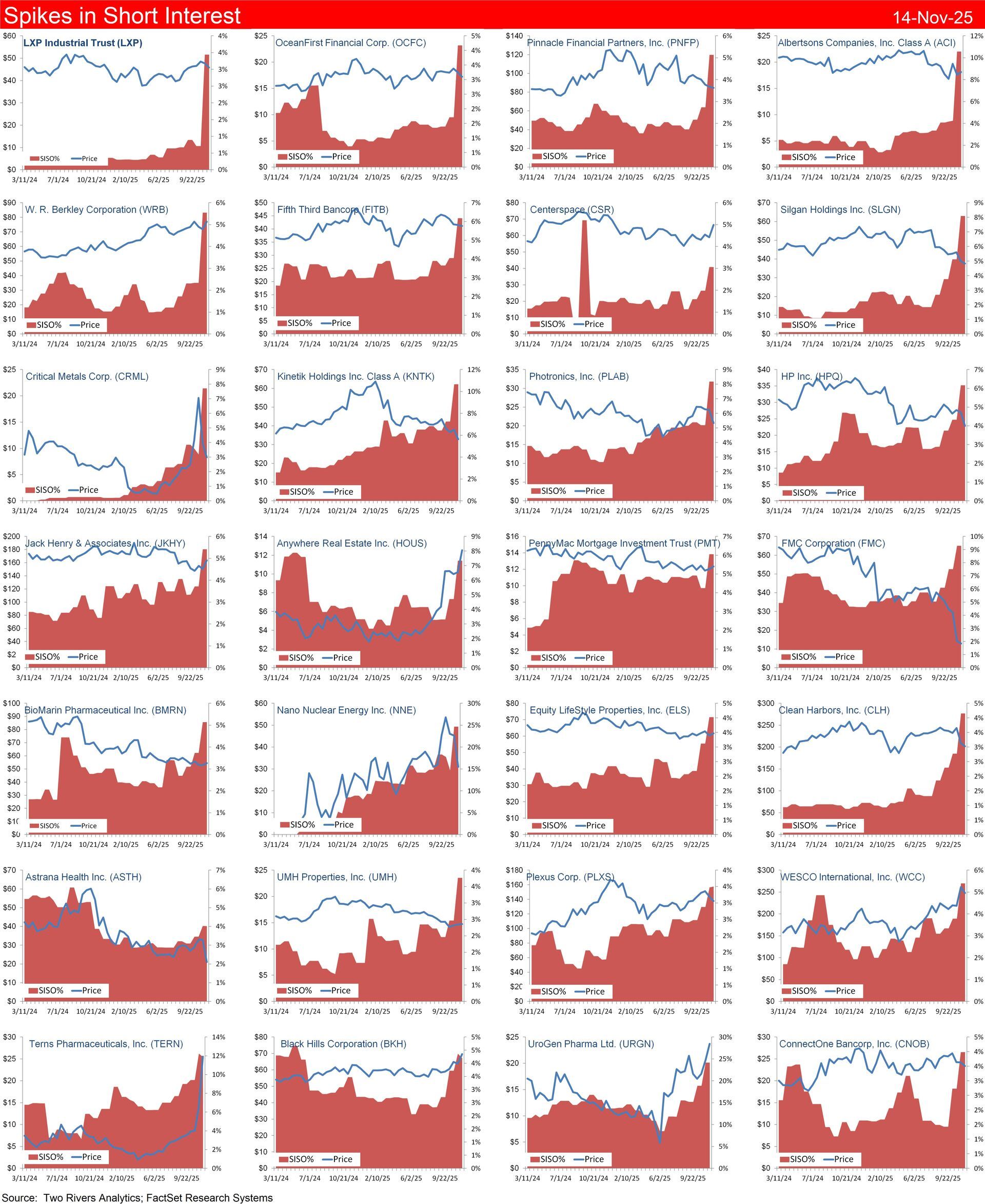

stocks showing recent spikes in short interest;

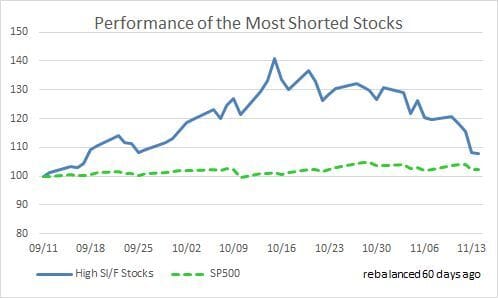

performance of the most highly shorted stocks.

The market value of short interest decreased by -2.9% ($-41.4) billion over the past 30 days. Net new active shorting decreased by $47.3 bn. The strongest short activity was seen in Semis, Data Processing and Internet Software. The most short covering took place in Packaged Software, Motor Vehicles and Internet Retail.

The most heavily shorted stocks are shown below. Any stock with short interest to float of more than 30% should be treated as a squeeze risk.

Spikes in Short Interest include: LXP Industrial Trust, OceanFirst Financial, Pinnacle Financial Partners, Albertsons Companies, W. R. Berkley Corporation, Fifth Third Bancorp, Centerspace, Silgan Holdings, and Critical Metals Corp.

Shorts are doing better

Highly shorted stocks are finally performing as they should. The risk-off turn is proving decisive.